What properties, locations, and amenities are driving the strongest short-term rental (STR) revenue in Big Bear Lake?

Big Bear’s vacation rental market is one of the most misunderstood, and most lucrative, real estate niches in Southern California. While the average cabin brings in modest returns, a small segment of properties consistently generates 6-figure to multi-6-figure annual revenue, driven by location, design, and the amenities today’s travelers are willing to pay a premium for.

For buyers, understanding what separates a top performing rental from an underperforming one is essential for making smart investment decisions. For sellers, knowing how your property stacks up, and how to position it ,can directly impact both time on market and final sale price.

In this guide, we break down the highest grossing vacation rentals in Big Bear Lake, the data behind their performance, and the patterns that drive the strongest ROI. Whether you’re evaluating a purchase, preparing to list, or simply want a clearer view of the market, this will give you a precise, real world understanding of where the true revenue is being made.

Market Reality: Top Performers Outpace Averages

According to AirROI, the typical Big Bear Lake STR pulls around $40K – $45K in annual revenue, the top 10% of properties consistently exceed $100K – $400K+ by combining location, capacity, pricing strategy, and amenities.

Key Benchmarks from 2025 STR Data:

-

Best-in-class properties (top 10%) often generate >$9,500/month and command $820+ ADR (average daily rate) in peak months.

-

Median listings average ~$3,000 – $4,000/month with ~$300–$360 ADR.

-

Peak revenue months are December – February (winter skiing and holidays drive occupancy and ADR)

These figures show that premium lakefront retreats and larger multi bedroom homes in high demand neighborhoods command substantially more revenue than the “average ” cabin. That’s a critical point when you’re brokering investment properties as luxury assets, not just lifestyle homes.

Examples of High Grossing Rentals in Big Bear

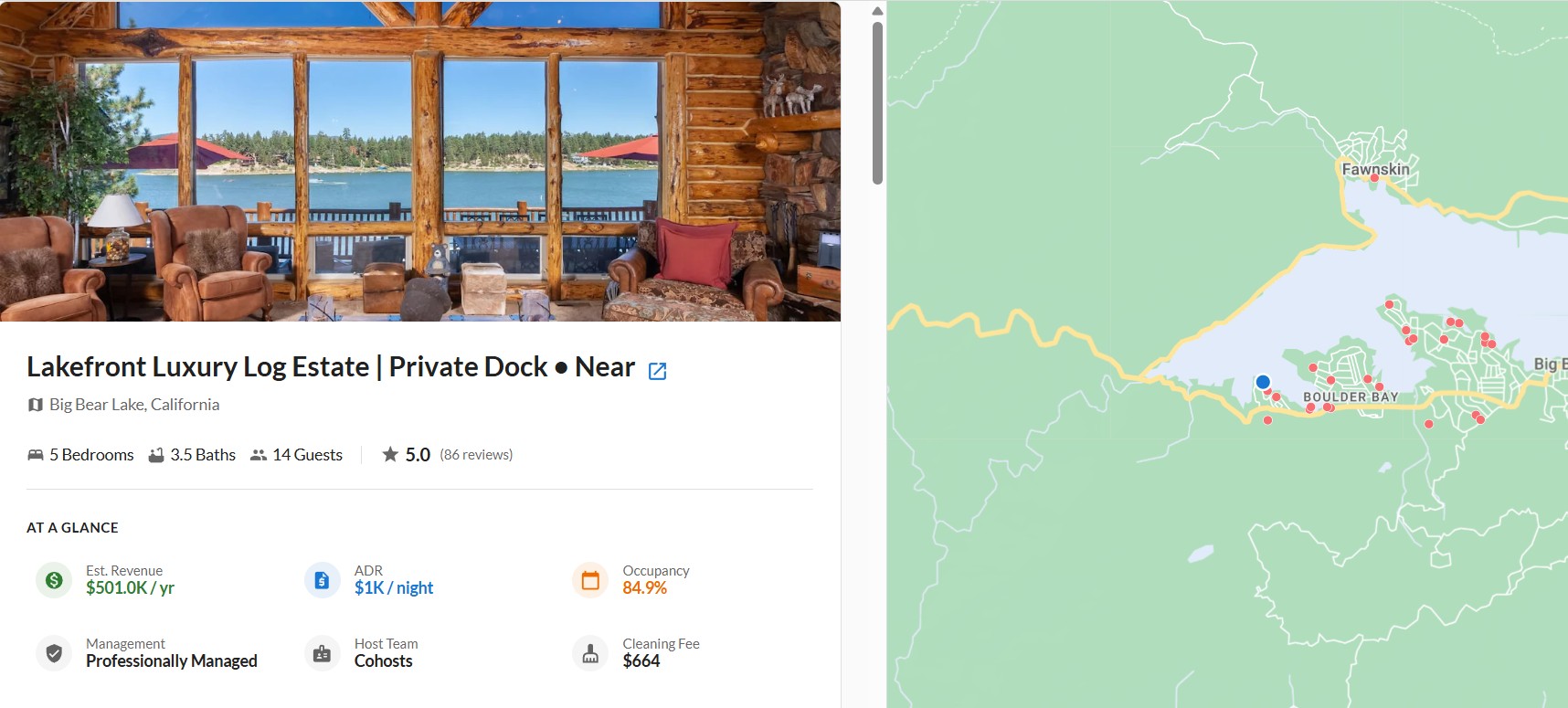

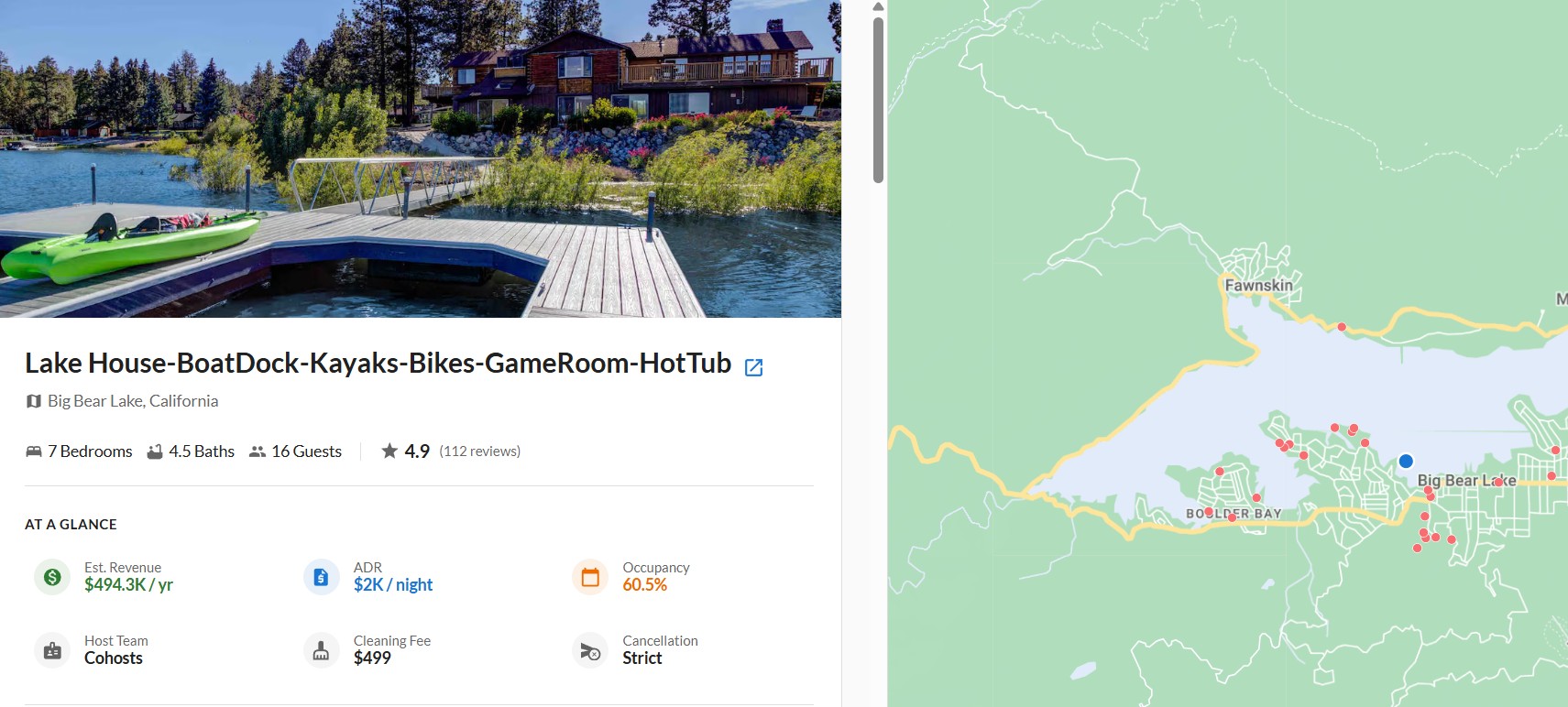

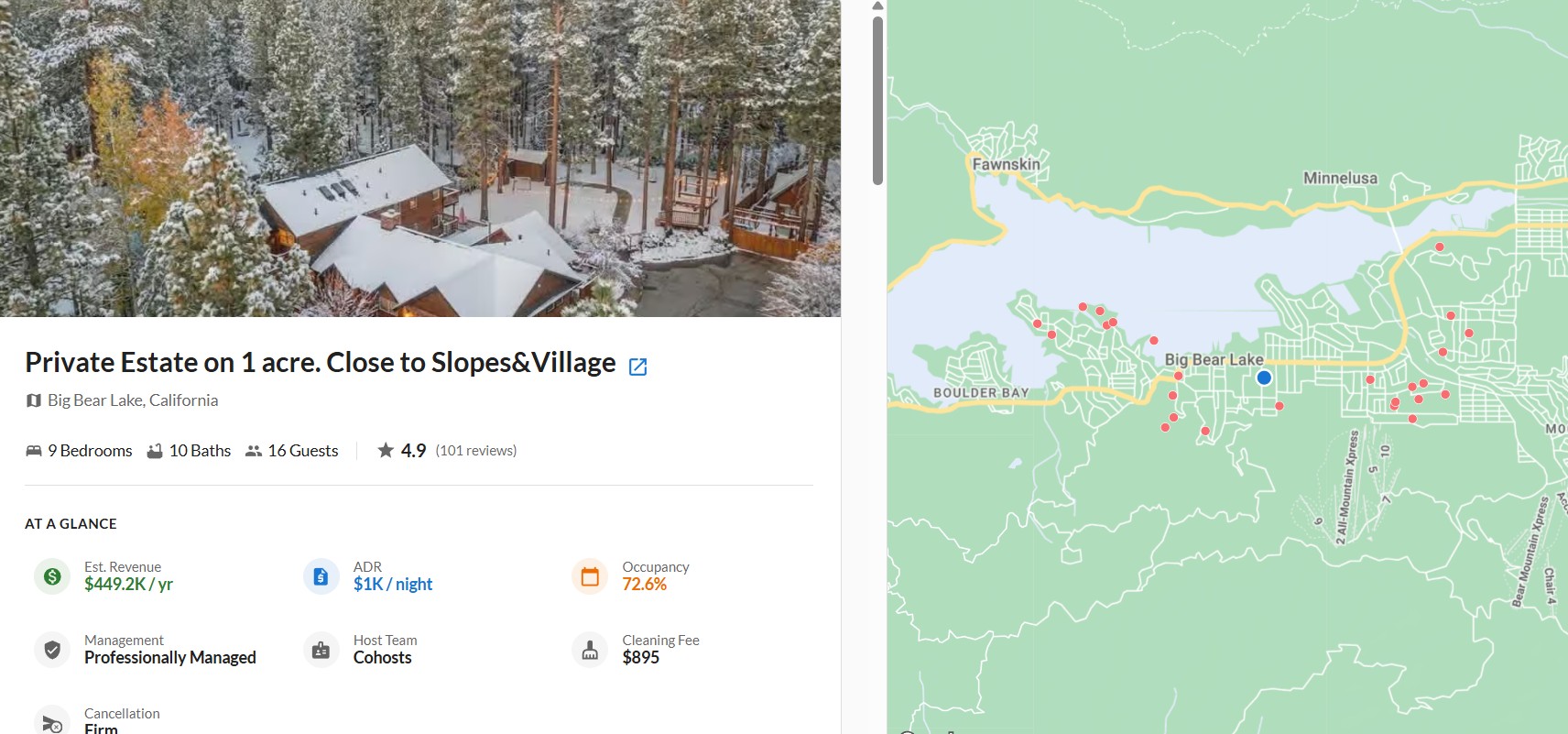

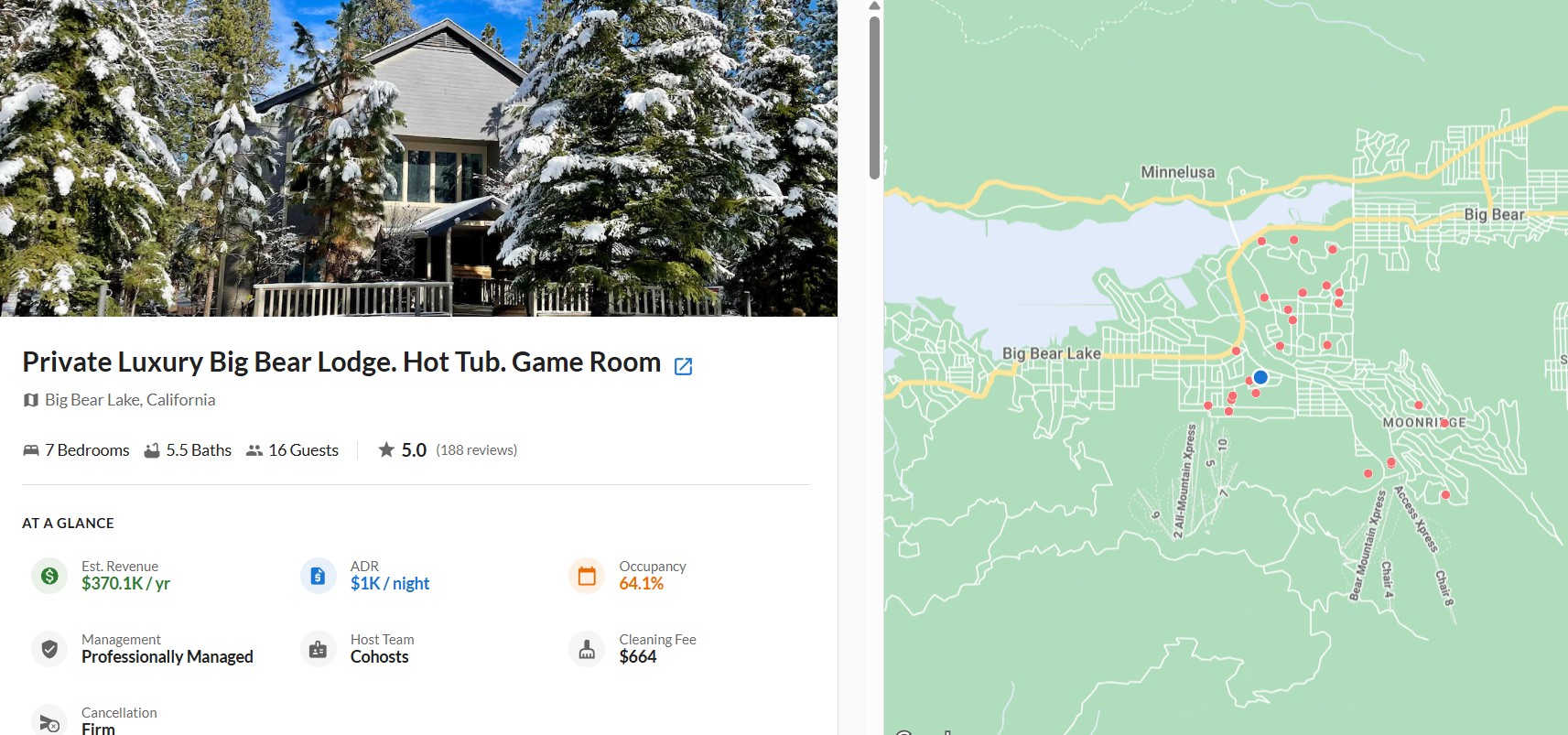

Based on the latest revenue tracking by AirROI, these examples illustrate what top-tier short-term rental performance looks like in the current Big Bear market:

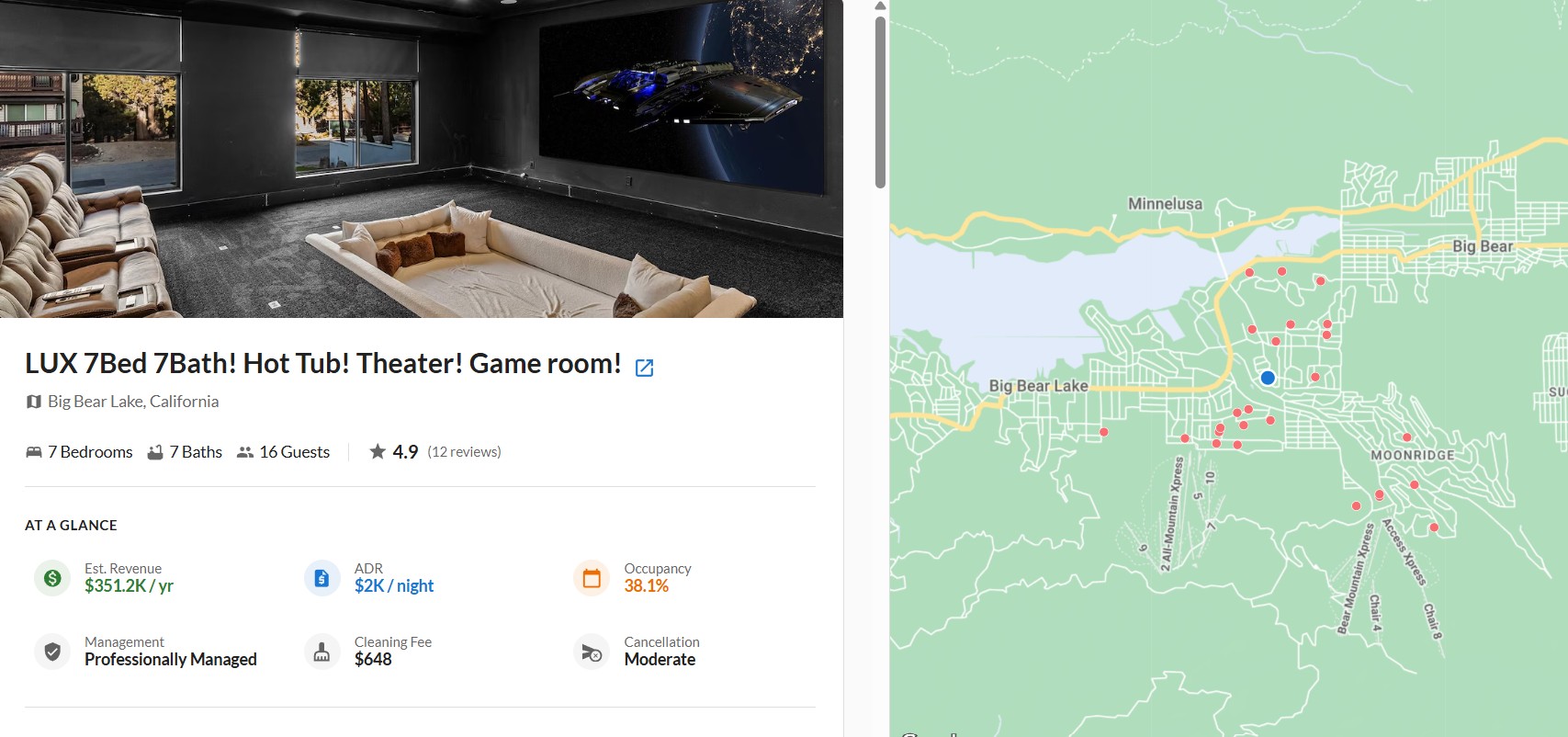

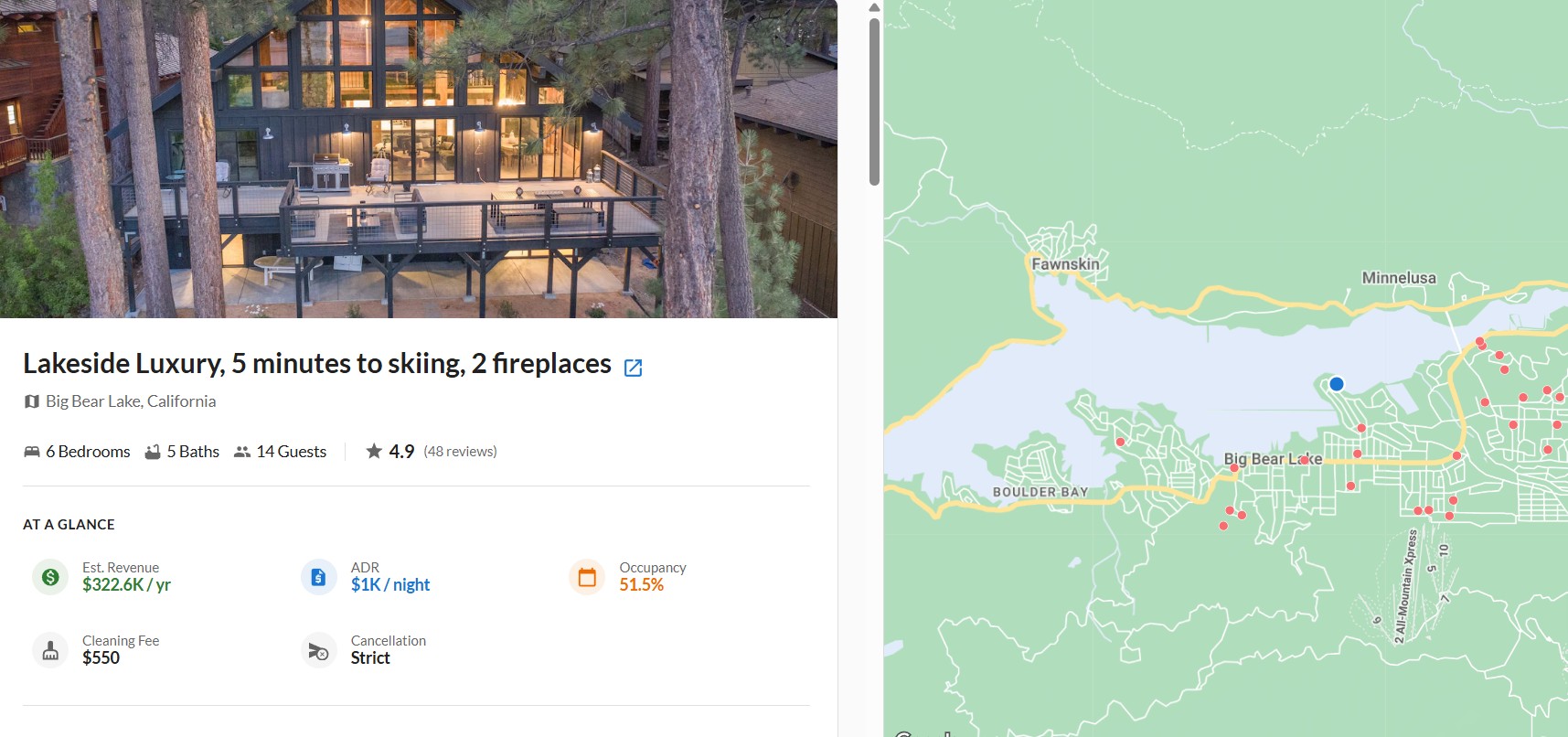

1. Ultra Premium / High Volume Earners

These listings illustrate a crucial pattern: high-occupancy capacity and luxury experience are a revenue multiplier. Larger homes with premium amenities like hot tubs, theaters, game rooms, lake views/docks, and luxury finishes consistently outperform smaller cabins, even after adjusting for seasonal dips.

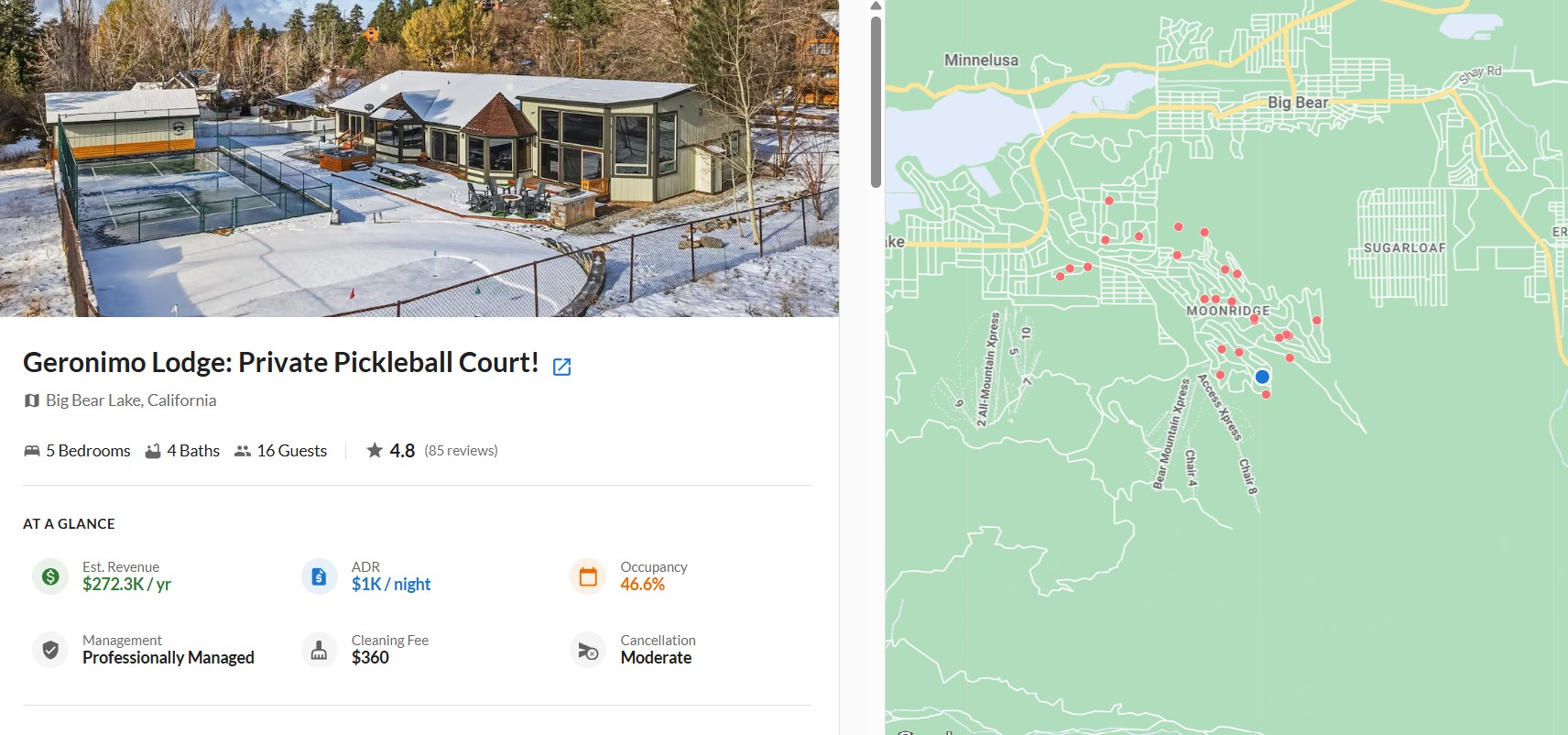

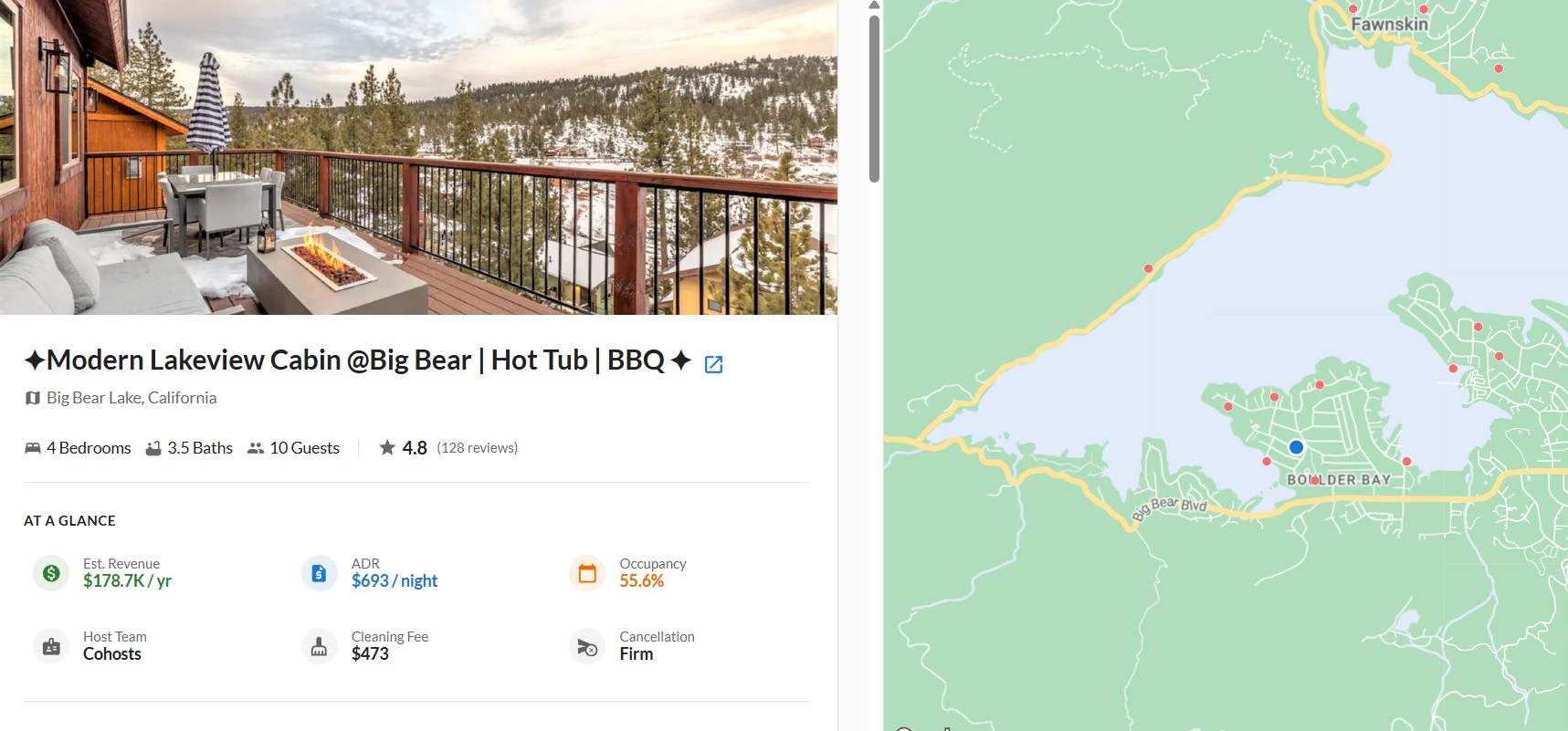

2. Mid-Tier Winners (Solid Revenue & Strong ADRs)

Not every big earner needs 8-9 bedrooms to succeed; strategically positioned midsize properties also perform well:

These demonstrate that an intentional design and thoughtful amenity mix can elevate a property into the top revenue brackets even without ultra large scale.

These demonstrate that an intentional design and thoughtful amenity mix can elevate a property into the top revenue brackets even without ultra large scale.

Why These Rentals Outperform: Market Mechanics

1) Location is a Primary Driver

Some of the highest revenue properties are:

-

Near Ski Resorts (Snow Summit / Bear Mountain)

-

In lakefront or lakeview neighborhoods

-

Close to Big Bear Village amenities, dining, and entertainment

2) Capacity and Group Appeal

Big Bear draws:

-

Multi-family groups

-

Friend getaways

-

Corporate retreats

-

Wedding/celebration bookings

Homes that sleep 8 – 12+ with luxury group oriented amenities consistently increase occupancy and ADR, especially on weekends and peak seasons.

3) Amenities Are the Key to Pricing Leverage

Listings commanding premium ADRs and revenue almost always include:

-

Hot tubs

-

Private docks / lake access

-

Game rooms / theaters

-

High end finishes & furnishings

-

Dedicated outdoor entertaining spaces

These features justify significantly higher nightly rates while boosting occupancy on slower days.

Strategic Takeaways for Buyers & Sellers

For Luxury Sellers

Position your listing as an income asset, not just a cabin.

Highlight metrics like peak ADR, occupancy trends, sleep capacity, and built-in revenue potential in your marketing. Demand for revenue-ready homes is robust among out-of-area buyers. Buyers across Los Angeles, Orange County, and San Diego see Big Bear as both a lifestyle and investment node.

For Buyers & Investors

Buyers willing to optimize for revenue outperform.

Focus on:

-

Location near ski access or village amenities

-

Homes with 6+ bedrooms

-

Properties easily marketed to groups

-

Amenities that differentiate in short-term rental listings

Leverage dynamic pricing tools, professional management, and seasonal rate strategies – these consistently push rentals into the top 10% revenue tier.

Final Thought

In Big Bear, not all vacation rentals are created equal. The properties that deliver exceptional experiences, namely lake access, views, thoughtful architecture, and luxury amenities, are the ones generating high-end, 6-figure annual revenue. For buyers and sellers alike, recognizing what elevates a property into the top tier is the fastest path to stronger returns and higher market demand.

If you’re evaluating a purchase, considering selling, or want a customized revenue analysis for your property, I’m here to help.

Paula Osborn

Global Real Estate Advisor

Vista Sotheby’s International Realty

(909) 747-5949

paula.osborn@vistasir.com

DRE 01943211

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link